“I grew up loving my faith community at St. Vincent de Paul. God definitely used these experiences to plant the seed of a religious vocation.”

Sr. Mary Faustina

Sacrificial Giving

Selecting the best gift plan depends on your personal financial situation and goals. We encourage you to consult with financial advisors to determine what method of contributing is most beneficial for you, as tax laws are always changing, and everyone’s situation is different.

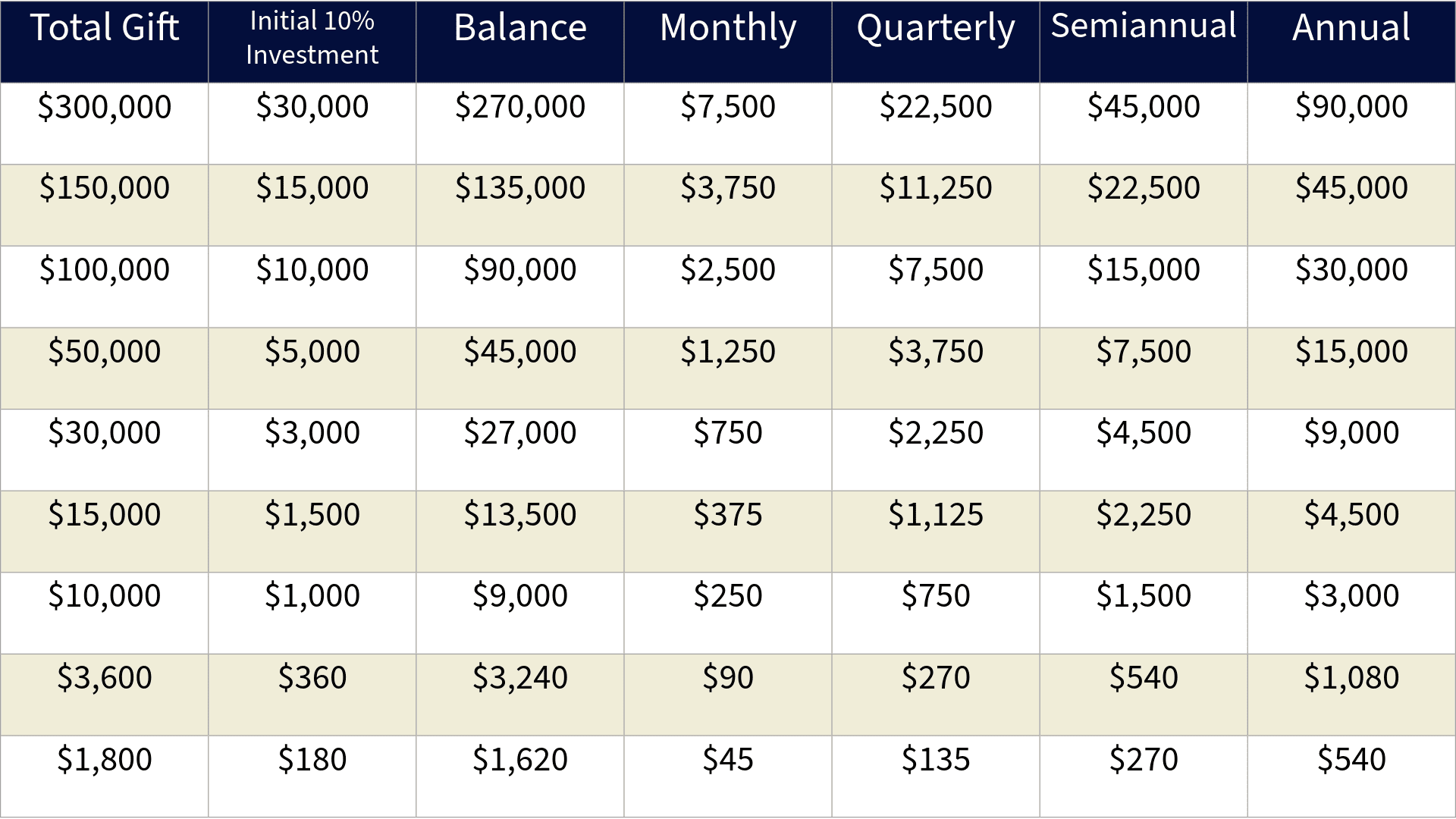

Many avenues of giving are available to allow you to support St. Vincent de Paul Catholic Church and School in a meaningful way. Pledges are commitments made in good faith and are not legally binding. You may want to consider stretching pledges over a three-year period to maximize the total amount of your support. This commitment can be fulfilled through monthly, quarterly, semiannual, or annual installments. To help the parish cash flow, we encourage all donors to consider a 10 to 20% initial payment to begin your commitment.

Gifts of prayer and consideration

No one can discount the value of prayer. Please pray for our church and school leaders so they will make the right decisions in guiding our parish now and in the future. We also pray for our fellow parishioners and school families as they consider what a meaningful gift means to them.

Gifts made by check, cash, or credit card

Online and personal checks are the most common ways donors make their pledges and donations and will allow St. Vincent de Paul to address our immediate needs. Checks should be made payable to St. Vincent de Paul Catholic Church (memo section: Gather and Grow Campaign).

Gifts of securities – stocks, bonds, and mutual funds

Charitable gifts of stocks, bonds or mutual funds, which have been held for at least one year and have appreciated, offer special tax advantages. You will receive a tax-deduction for the full market value of the gift, but you will not have to pay capital gains tax on the appreciated amount. If you sell depreciated stock and contribute the proceeds, you will receive both a tax deduction for the charitable gift and a deduction for the capital loss.

Corporate matching gifts

A matching gift program provided through your employer or a board membership may allow you to increase the value of your gift. Many companies match charitable gifts made by their employees, retirees, or board members.

Planned gifts

Planned giving is the process of carefully selecting the best method and assets for making a charitable gift. Such a gift can enable you to take full advantage of the tax laws to accomplish your financial and charitable goals. A bequest contained in your will is the most common form of planned giving, or you can name St. Vincent de Paul as a primary or contingent beneficiary of a retirement plan.

Note: This information is not intended as legal advice. You are advised to consult your own qualified professional adviser for specific recommendations.

Budgeting Your Gift

The following chart is provided as a guide as you prayerfully consider your level of support over a three-year period.